Xi Focus: Backgrounder: China's opening-up endeavor since the first CIIE

China has taken concrete steps to open up its market since the first China International Import Expo (CIIE) in November 2018, a major measure for China to take the initiative to open its market to the world.

The opening-up process is a well-rounded one that includes widening foreign access, increasing commodity and service imports and improving the business environment.

China seeks to expand foreign access to its financial sector by abolishing restrictions and adding investment options.

To facilitate foreign investment in the interbank bond market, China scraped investment quota limits for Qualified Foreign Institutional Investors (QFII) and Renminbi Qualified Foreign Institutional Investors (RQFII) and allowed the non-transacting transfer of bonds under the same overseas entity QFII/RQFII and direct entry channels, and direct transfer between capital accounts.

For the stock market, overseas investors are encouraged to invest in the Nasdaq-style sci-tech innovation board known as the STAR market. The Shanghai-London Stock Connect program opened for trading in June as another channel for foreign capital inflow.

Foreign ownership limits on futures companies, fund management firms and brokerages will also be lifted next year.

Market access is eased for foreign firms by shortening the negative list of sectors and businesses that are off-limits for foreign investors to 40 items from 48. Upstream exploration of China's oil and natural gas resources by foreign companies, as well as ownership restrictions in entertainment and telecommunications services, were among the items taken off the list this year.

Efforts to increase imports are evident in China's move to set up six new pilot Free Trade Zones (FTZs) located in the six provincial-level regions of Shandong, Jiangsu, Guangxi, Hebei, Yunnan and Heilongjiang, bringing the total number of the country's pilot FTZs to 18.

China's import has been growing at an average rate of 8.25 percent annually from 2016 to 2018 and is expected to top 2 trillion U.S. dollars in 2019, according to official data.

The total commodities and service imports over the next 15 years are estimated to exceed 30 trillion and 10 trillion U.S. dollars, respectively.

To render a better business environment and provide overseas investors with stronger protection, China approved a landmark foreign investment law and introduced a new regulation on optimizing the business environment, both set to take effect on Jan. 1, 2020.

The two legal documents are expected to make foreign investment policies more transparent, grant equal playing field for foreign-invested enterprises in market competition and strengthen protection of intellectual property rights.

China's opening-up determination is met with acknowledgment worldwide.

According to the latest World Bank report, China's ease of doing business ranking rose to 31 this year from 46 last year, and it is also among the 10 economies that improved the most on the ease of doing business after implementing regulatory reforms.

Major global benchmarks like MSCI, FTSE Russell and the S&P Dow Jones Indices either strengthened the weighting of China's A-shares or included the A-shares into the indices, effective from August and September.

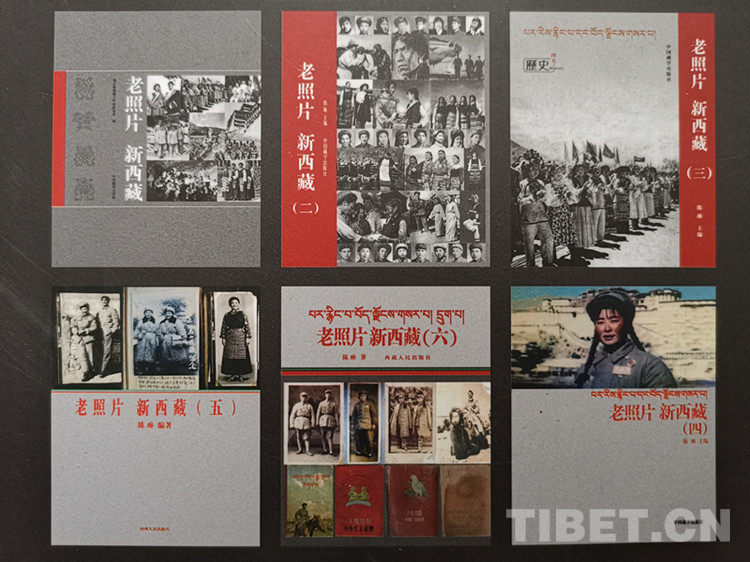

Tibet Stories

Visiting the Sichuan Ngawa Xiangzang Art School

Trizeng Rabten started painting as a hobby. He first studied the techniques of the Karma Kac...